If you have ordered a SwiftCheck report and you have not received it in your email inbox, please check your junk mail folder.

If you still cannot see the report, please contact us and we will email you a copy of your latest report request within 2 business days.

For all billing enquiries, please contact us. All queries will be responded to within 2 business days.

If you believe there is something incorrect on your organisation’s credit file, you will be required to provide specific details of the entries you are disputing, such as the date the entry was listed on your credit file, account/reference numbers and amounts. Please ensure you have the details of all dispute entries before proceeding with the submission of a correction request. If you do not have a current copy of your organisations credit report or the specific details of the disputed entries, you may not able to complete the correction request form.

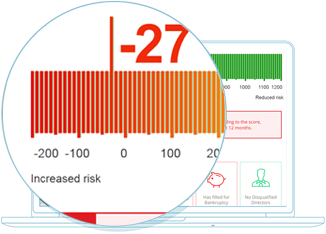

There are a number of factors that go into making up a credit score. If you have defaulted on paying any invoices, have multiple credit enquiries in a short period of time, have any outstanding legal actions or have gone into external administration, then events such as these could result in a low credit score.

To find out more about what has affected your credit score, you can purchase a SwiftCheck report.

If you wish to submit a correction request with Equifax here's how it works:

1. Commercial correction request is received

The more information you can provide, the quicker we can investigate. If you are requesting on behalf of someone else, please also include the requester their details.

Running a small business is no easy feat. That's why we are creating a series of online small business resources for expert insight, hints and industry knowledge you need to help your business grow.

Got questions about SwiftCheck or our reports? Find the answers to the questions we are most frequently asked in our FAQs section.

Tips for searching a business

See features and benefits

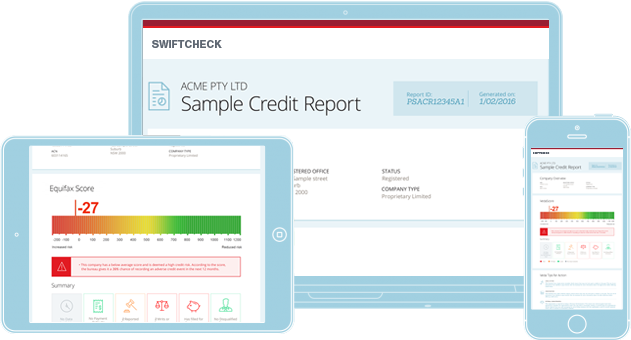

View sample credit report

-

Refine your search

Not seeing the results you expected? If your search produces too many results or you can't find the one you're looking for, try using the ABN or ACN.

Who we are

SwiftCheck is powered by Equifax, one of Australia’s leading commercial credit reporting bureaus.

The information you can access through a SwiftCheck report can help you to:

SwiftCheck reports make it easy to understand your customers' level of risk. Search for a business

Access to Australia’s leading commercial bureau

SwiftCheck is powered by Equifax, a leading provider of insights and knowledge that helps customers make informed decisions. Equifax powers the financial future of individuals and organisations around the world using the combined strength of unique trusted data, technology and innovative analytics.

SwiftCheck gives you 24/7 access to these insights in an easy-to-understand report, with the convenience of credit card payment.

A credit score for businesses

It’s not enough to understand if a business is currently solvent. An Equifax Score can identify if potential customers or suppliers that are likely to fail so that you can take action today to reduce any impact on your business. An Equifax Score is highly predictive and uses multiple data sources to calculate including the credit history of the business, the commercial credit history of the directors and owners, and how well the business pays their invoices.

A detailed report that's easy to read

A SwiftCheck report contains the information you need to make a fast and easy decision around the likely impact a new customer might have on your business' cash flow.

Areas that require further investigation are summarised at the beginning of the report, and there are also Equifax Tips throughout that can help steer you to the right decision to protect your business from potential risk.

Avoid late payers with invoice payment history

A business may have a low risk of going insolvent, but if they are a notorious late payer this can have a significant impact on your cash flow, and perhaps your need for finance if the order is large. Knowing how fast your customer pays other businesses can help you minimise the impact taking an order will have on your cash flow.