Due to additional requirements to validate business proprietor information the Company & Director Credit Report is only available for searches on Companies with an ACN.

Company Report

$99.95

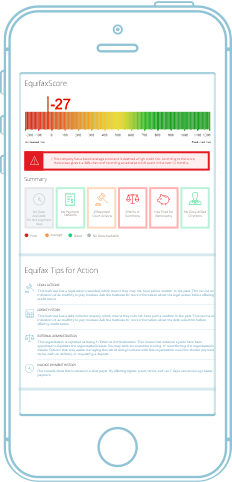

- Credit Score

- Tips for Action

- ASIC Information

- Shareholder Details

- Defaults, Court Actions, External Administration information

- Directors Information

Title

What does this report include?

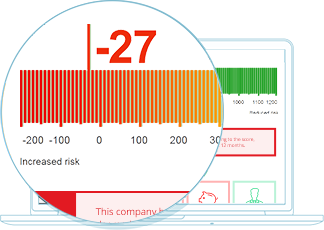

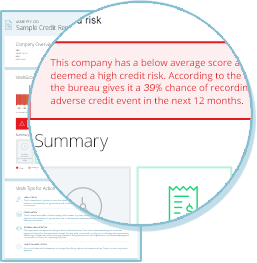

- Credit Score – a helpful, easy-to-read indicator representing the creditworthiness of a business.

- ASIC registered company information – including ABN/ACN, shareholders, registered address, date of incorporation.

- Company credit information - defaults, court judgements and external administration (if applicable).

What are the key benefits?

- Validate a business is registered and solvent, so you know who you’re doing business with.

- Understand the level of risk the business poses so that you can manage your exposure to bad debt

- Make fast, well-informed decisions. Reports are delivered instantly.

Title

What are the key benefits?

- Validate a business is registered and solvent, so you know who you’re doing business with.

- Understand the level of risk the business poses so that you can manage your exposure to bad debt

- By including director data in the risk assessment, you get more valuable insight into the people behind the business that can help you to make well informed decisions.

- Understand how fast a business pays their bills with invoice payment history information, so you can better manage your cash flow.

- PPS Registration information helps you to better understand where you stand as a creditor in the event of a default or external administration.

- A quick and simple report, available in a matter of minutes, tthis report allows you to easily gauge credit risk and make informed decisions based on current, registered business information.

Test

Search for a Business

View sample report

The Report is suited for medium-risk business decisions.

What are the key benefits?

- Validate a business is registered and solvent, so you know who you’re doing business with.

- Understand the level of risk the business poses so that you can manage your exposure to bad debt

- Get more valuable insight into the people behind the business to help you to make well informed decisions.

- Understand how fast a business pays their bills with invoice payment history information, so you can better manage your cash flow.

- Reports are delivered to you in a matter of minutes.

Test

Cash flow has always been an issue for small and medium businesses (SMEs), who are faced with the harsh reality of needing to pay invoices quickly, while larger businesses’ repayment rates are significantly slower – 1.5 times on average.

Any person or organisation (the complainant) who is dissatisfied with a product or service provided by Equifax for any reason has the right to make a complaint to us. We will endeavour to align our procedures with the relevant legal requirements and best practice as soon as possible.

How and where to complain

You can let us know about your complaint and how you've been impacted by using any of the contact details below.

To view more details about your organisations credit enquiries, you must be a registered director or company secretary of the organisation. If you feel that the credit enquiries listed on your report are incorrect, you will need to first get a Business Credit File report.

To request this report, please enter your details at MyCreditFile.com.au.

If you have a dispute regarding your trade payment information, please email your enquiry to [email protected].