For media queries please contact us on [email protected].

Looking for more news and media? Visit our archive.

Mortgage demand hits four-year high as a second consecutive quarter of double-digit growth for credit cards is observed and most prominent among younger Gen Z’s.

Read more

Mortgage arrears accelerate as the impact of interest rate rises becomes more pronounced

Nearly a quarter of mortgage surveyed brokers expect to take on more refinancing loans this year

The long-anticipated insolvency backlog ‘tsunami’ may finally be coming to shore.

Credit card demand continues to grow

Business credit demand decreased year-on-year in the December quarter, with commercial enquiry volumes falling across all product types.

Mortgage demand continues to fall, while personal loan arrears suggest further financial turbulence ahead

Equifax Group Managing Director, Melanie Cochrane, explains why financial inclusion should be a top-of-mind issue as Australia braces for an economic slowdown. The vulnerability of financially excluded groups who struggle to access credit is likely to escalate with increased pressures on household budgets. With limited or no access to the credit system, it's harder for Australians to start or grow a business or take control of their financial wellbeing in a way that contributes to the broader economy.

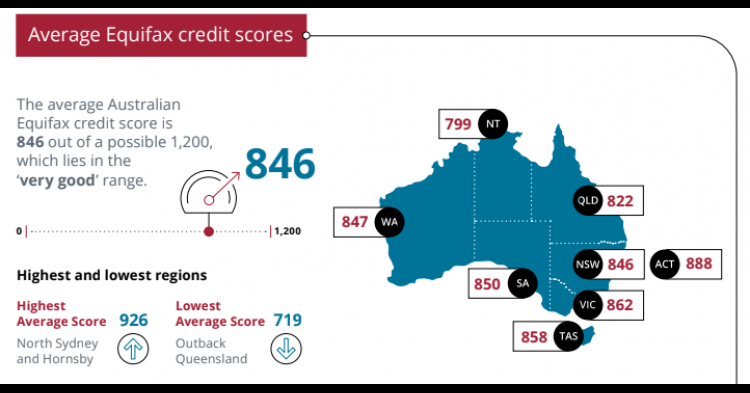

Australians are now taking strategic action to improve their finance and credit standing to combat an uncertain economy, reveals the Equifax Australian Credit Scorecard 2022

Introducing the Equifax A/NZ Sustainability 2023 Focus Areas

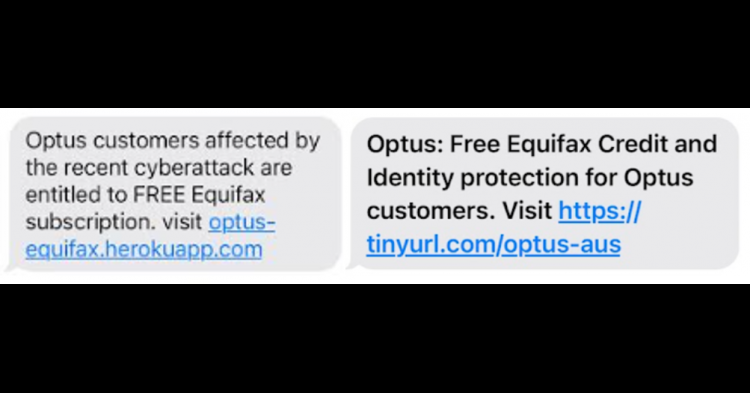

Equifax is aware of an ongoing SMS phishing campaign targeting people impacted by the Optus data breach. DO NOT click on the link, respond to the sender or enter your personal information. Equifax will never ask you to validate your identity by providing your credit card details.