Our handy guide will help you understand each section of your SwiftCheck report and make it easier for you to use the information to make better credit decisions in your business.

Business/Company Overview

The business overview is a summary of the business including ABN and ACN details, principal place of business and its current status. This will give you a quick overview of the business at a glance.

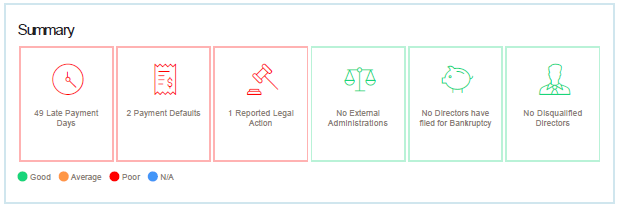

Summary

The summary section helps you to quickly identify the most critical pieces of information that will impact a business’s risk at a simple glance.

To make it even easier, the summary is ranked using a traffic light system with green meaning everything is good, amber is ok and red is poor and needs some closer attention.

Equifax Score

The Equifax Score is created using a complex algorithm developed by Equifax’s scoring team, that assess a business on a range of different criteria, to give a rating out of 1200.

A credit risk score not only tells you the status of a business today, but the likelihood of them going insolvent in the future.

The Equifax Score is ranked from -200-1200 with a higher number meaning a lower credit risk.

Equifax Tips

The Equifax Tips section is a set of actions that you can take to help minimise your risk. These are developed by industry professionals to help small businesses more effectively manage their cash flow and reduce the risk of not getting paid. The tips are generated specifically for each business, depending on a range of key criteria returned when a report is generated.

Australian Business Number Details

This section displays key business information taken directly from ASIC. This can be the ACN or ABN, the current directors, registered office and current status.

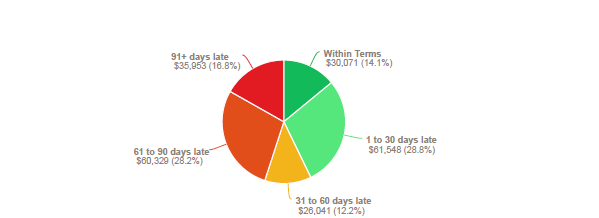

Invoice Payment History

The invoice payment history section will provide you with insight into how quickly this business pays its invoices. This information is taken from over 20 million trade payment references across Australia.

The invoice payment history pie graph breaks down outstanding amounts according to payment terms, so you can easily see if a business is paying ‘within terms’, ‘1 to 30 days late’, ‘31 to 60 days late’ or ‘90 or more days late’. If a business is seen to be paying all its invoices very late it’s something that you can consider in your cash flow projections.

Credit History

This section provides you information on the credit enquiries that have been made by this customer. Credit enquiries can be a good indicator or a potential risk, with more enquiries indicating possible difficulties.

Payment Defaults

The payment defaults section provides you with information around payment defaults that have been recorded against this organisation. A payment default occurs when a business has failed to pay outstanding invoices after a considerable time period, resulting in a default being registered against that organisation.

If there have been any defaults registered, a warning box will appear providing you with details of the default and some tips on how to handle this.

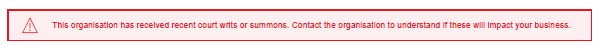

Legal Action

The legal action section is a summary of any instances where the organisation has been involved in legal action related to debt. This can be in the form of a writ or a court summons in regards to late or non-payment of an invoice. If there are outstanding legal actions, this can be a

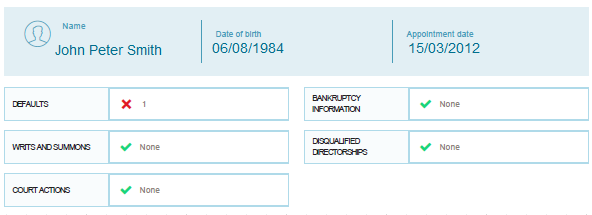

Directors and Shareholders

Directors have a critical impact of the performance of a business. This is why it is important to have as much information on the directors of the company you are dealing with.

The directors section lists out any defaults, bankruptcy information or court summons that may impact on their ability to run a business.

Got questions about your SwiftCheck report?

Check out our FAQs section to find answers to frequently asked questions.