Rise in Construction Defaults Shows Early Signs of Moderation

But construction industry insolvencies continue to increase on an annual basis, jumping to 24% for the September 2019 quarter.

The latest statistics1 by the Australian Securities and Investment Commission (ASIC) reveal that the construction industry is a leading contributor to Australia’s rising rate of company defaults2 (EXADs). The impact of failed construction companies is especially noticeable in the eastern seaboard, where insolvencies increased in Victoria by 78%, Queensland by 41% and NSW by 7% for the September 2019 quarter (QoQ).

Despite these difficulties, the sector is showing some positive signs. Following a spike in insolvencies in July 2019, there was a continuous reduction in overall construction defaults in August and September month-on-month.

- Construction industry defaults increased by 28% quarter on quarter (QoQ). Up 24% YoY.

- Victoria was the hardest hit, with defaults increasing by 78% QoQ. Up 107% on the prior comparable period (PcP).

- Queensland defaults were also up, rising by 41% QoQ. Up by 14% PcP.

- NSW continued the eastern seaboard downward trend, with defaults up by 7% QoQ and 49% PcP.

Head of Product and Rating Services at Equifax, Brad Walters, said there is no doubt that construction is suffering, particularly across the eastern seaboard, but there are tentative signs of improvement.

“Across all industries3, the average annual growth of defaults remains firm at 5% year-on-year. Looking specifically at the September 2019 quarter, the number of companies in Australia that went under increased by 10% compared to the previous quarter.

Walters says a decline in residential apartment approvals has led much of the downturn in construction. Here we look at the story behind the sector.

Construction defaults bite hard along the eastern seaboard

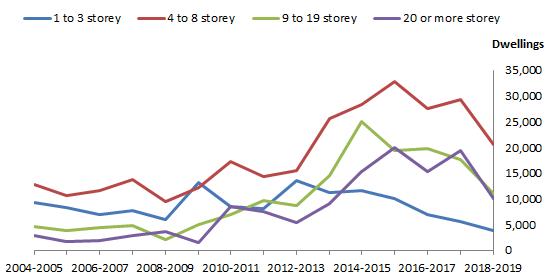

The eastern seaboard states of Victoria, Queensland and NSW are feeling the effects of a six-year low4 in new apartment approvals. On average5, these three states make up 80% of the total dwelling approvals across Australia, and 86% of all apartment approvals. All apartment heights6 are affected:

- 60.8% fall in low-rise (1-3 storey apartments)

- 37.1% fall in medium-rise (4-8 storey apartments)

- 43.3% fall in high-rise (9-19 storey apartments)

- 47.6% fall in super high-rise (20+ storey apartments)

Apartments approved by number of storeys, Australia – 2004-05 to 2018/19

Source: ABS 8731.0 - Building Approvals, Australia, Sep 2019 (released 31/10/2019)

Victoria shoulders the decline

Victoria7 has Australia’s highest proportion of super high-rise apartments. And it’s in this 20-plus storey category that the contraction in approvals has been significant, with a year-on-year fall of 58.5%.

In contrast, most apartment approvals in NSW8 are in the medium-rise category of 4 to 8 stories high. Overall medium-rise apartments have experienced a 37.1% fall, which is not as severe as the other apartment height categories.

Queensland’s9 apartment approvals have significantly declined since it experienced an unprecedented boom between 2014 and 2016. High-rise and super-rise apartments are particularly affected, collectively falling by 76%. Because this contraction occurred over three years, the decline is not as marked as Victoria, where approvals dropped 58.5% in a single year.

Why fewer apartments get the green light

“If the contraction in apartment approvals is responsible for the increased construction sector defaults, let’s look at why there has been such a reduction in approvals,” says Walters.

“We have observed a period of significant activity with the supply of available building stock coming online. Following a moderation in demand, its reflective of where we’re at in the property cycle. Of course, multiple factors are affecting this, including how much harder it has been for owners, investors and developers to access finance and insurance.”

A softening of consumer confidence, adds Walters, has been exacerbated by rising concerns around flammable cladding, water-proofing issues and/or structural defects, with buyers questioning the quality of residential builds.

“Add to this, subdued business spending with international trade tensions impacting activity levels and investment, and global economic risks tilted to the downside.

All of these factors have contributed towards the reduction in confidence and the fall in the number of apartment approvals,” he adds.

Positive news in August and September

Following a spike in construction sector insolvencies in July 2019, defaults decreased10 month-on-month over August and September.

“Construction EXADs in August were lower than July. September was lower again than August,” says Walters.

While the number of dwellings approved11 remains 19% down from the same time last year, in seasonally adjusted terms, total dwelling approvals actually increased by 7.6% in Sept (MoM). In the same month, the trend estimate of the value of total buildings approved rose by 1.4%. This upward trend has continued now for nine months.

We also see some positive signs in house prices and clearance rates in an environment where interest rates are anticipated to remain low, says Walters. At the same time, mortgage applications are increasing12, and the rate of decline in business credit demand is slowing13. New lending commitments14 to households has now increased for four consecutive months and is up 17.3% on the most recent trough in May 2019.

“The non-residential building sector continues its growth trajectory, and we also anticipate a strong rebound in infrastructure construction. While this may not be enough to offset the downturn in the residential building sector in the short term, it should start to impact overall construction levels in 2020,” says Walters.

“Keep in mind this stimulus will take time to flow through, so expect any improvements in the construction sector to be slow and gradual.”

Keen to protect your business from insolvency? Email us to find out how we can help.

________________________

1 ASIC Insolvency Statistics – Series 1A: Companies entering external administration by industry, Sept 2019 (released Nov 2019)

2 Companies entering external administration (EXADs), ranging from court wind-ups, creditor wind-ups, receiver appointments, voluntary administration, etc

3 ASIC Insolvency Statistics – Series 1: Companies entering external administration, Sept 2019 (released Nov 2019)

4 ABS Building Approvals, Sep 2019 (31/10/2019) – Characteristics of apartment approvals

5 ABS Building Approvals, Sep 2019 (31/10/2019) – Characteristics of apartment approvals, Major state summary, Graph 4,5 & 6

6 ABS Building Approvals, Sep 2019 (31/10/2019) – Characteristics of apartment approvals, Graph 2

7 ABS Building Approvals, Sep 2019 (31/10/2019) – Characteristics of apartment approvals, Graph 5

8 ABS Building Approvals, Sep 2019 (31/10/2019) – Characteristics of apartment approvals, Graph 4

9 ABS Building Approvals, Sep 2019 (31/10/2019) – Characteristics of apartment approvals, Graph 6

10 ASIC Insolvency Statistics – Series 1A: Companies entering external administration by industry, Sept 2019 (released Nov 2019) Table 1A.1.2 - Companies entering EXAD–Region and industry summary, Monthly

11 ABS Building Approvals, Sep 2019 (31/10/2019) – Main Features

12 Equifax Quarterly Consumer Credit Demand Index, Sept 2019

13 Equifax Quarterly Business Credit Demand Index for Sept 2019.

14 ABS Lending to households and businesses, Australia, Sept 2019 (8/11/2019)

Related Posts

Highlights:

Mitigate the surge in AI-generated digital forgeries by moving from document-based checks to source-verified payroll data Combat sophisticated salary staging and liar loans with an automated, single source of truth Establish digital trust at the point of contact to protect your organisation from credit and compliance risks.