More than 3 in 5 merchants agree that reform of the Buy Now Pay Later (BNPL) sector will encourage more businesses to adopt this payment option, according to an Equifax survey. Our survey into the future of BNPL finds Australian merchants are reacting positively to government regulation of BNPL – while simultaneously realising that care must be taken to maintain a balance between consumer protection and user experience.

Post-reform outlook: Regarding the state of play post-legislation, 57% of merchants surveyed believe reforms are a positive move, and 59% expect they will protect younger, less savvy consumers.

There is also the view that if consumers find it harder to get approval, usage may drop, and banks and prominent BNPL providers will dominate. If a global brand enters the market, 57% expect this provider to gain traction over local BNPL brands.

Financial inclusion: Just over half (53%) of merchants surveyed view BNPL as important for financial inclusion. With BNPL on track to be regulated as a credit product by the end of 2023, introducing consumer protections like credit and affordability checks across the industry is expected to raise the bar for positive consumer outcomes.

Having an active credit account is crucial to building a credit profile and improving credit scores, so it is here that a regulated BNPL sector can help those Australians disenfranchised by traditional finance. Leveraging data analytic insights to understand each borrower’s circumstances and extend credit responsibly gives more Australians a meaningful opportunity to take control of their financial future.

An opportunity to increase purchase value size: The merchants surveyed are adopting more innovative electronic payment solutions alongside growing consumer demand for greater convenience. Their takeup of e-wallets (72%) and BNPL (100%) rivals their use of other payment options like credit cards (92.3%), debit cards (84.7%) and direct bank transfers (72.5%). Merchants reported that their customers had used BNPL (98%) and e-wallets (90%) at least once or multiple times.

Merchants told us the number one reason they are attracted to BNPL is its ability to increase the average cart size, with buyers willing to spend more when they know they can split up payments to manage their cash flow better.

As legislative reform strengthens confidence and trust in the BNPL brand, more consumers may be ready to expand their purchases with BNPL and boost their cart size. BNPL providers can use data and risk analytics to increase purchase value size responsibly to the right consumers.

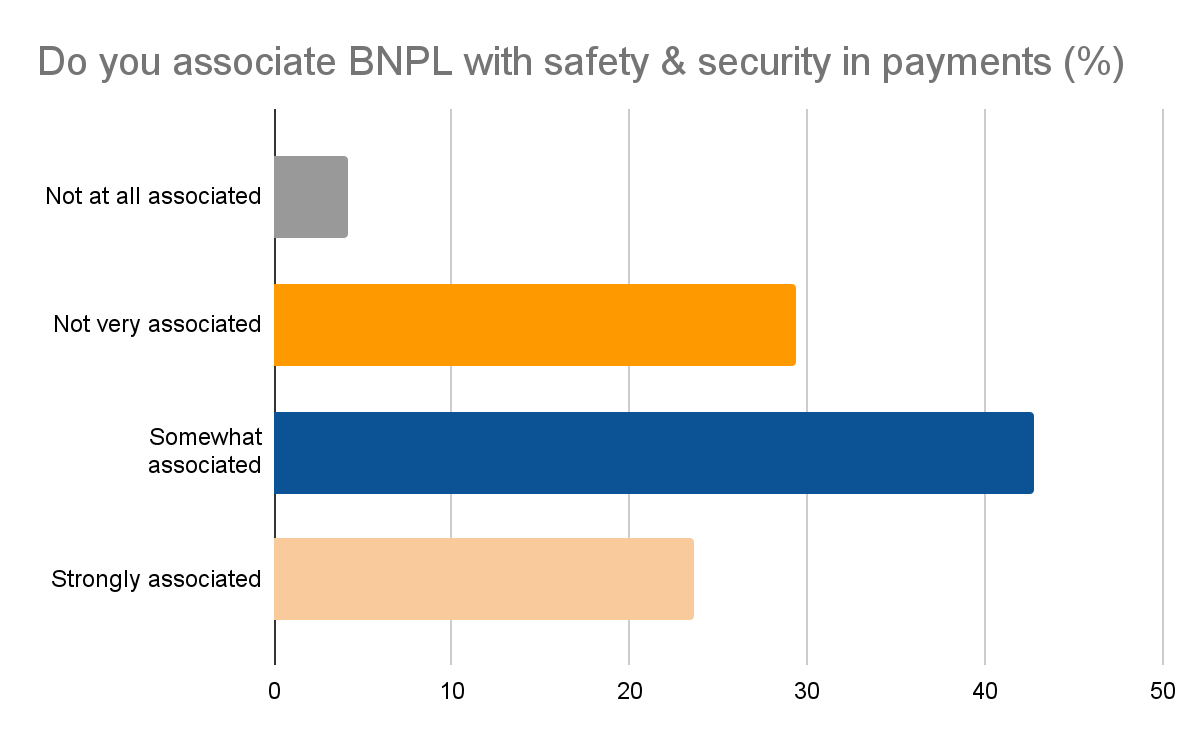

Trust in BNPL safety and security will increase: Less than 1 in 4 merchants surveyed strongly associated BNPL with safety and security, while 43% considered it to be ‘somewhat associated’, and 30% found it ‘not very associated’.

Given this low trust perception with data security, legislative reforms open the way for BNPL to become synonymous with data protection while maintaining a low-friction experience. Consumers, merchants and regulators will expect BNPL providers to provide intuitive solutions for preventing fraud and lending responsibly. Lowering customer hesitation towards BNPL can drive user loyalty and profitability.

BNPL lenders can leverage credit and alternative data assets to predict payment risk across the entire customer journey, helping to forecast delinquency, reduce second-pay default rates and identify creditworthy prospects. Digital ID verification and risk scoring can detect abnormal login or account activity and enable fast approve/decline decisioning for seamless onboarding.

Interested in finding out what else our survey found about the views and perspectives of Australian merchants? Download a complimentary copy of our whitepaper to see the four emerging themes and what this means for BNPL providers.

Contact our sales team to discover how Equifax can help BNPL providers build profitability while promoting responsible lending with positive consumer outcomes.

Related Posts

Highlights:

Mitigate the surge in AI-generated digital forgeries by moving from document-based checks to source-verified payroll data Combat sophisticated salary staging and liar loans with an automated, single source of truth Establish digital trust at the point of contact to protect your organisation from credit and compliance risks.