News, opinions and discussions to enhance the

way you think about data and analytics.

Introducing the Equifax A/NZ Sustainability 2023 Focus Areas

While there is no silver bullet for the prevention of cybercrime, there are measures your organisation can take to minimise the impact of a data breach.

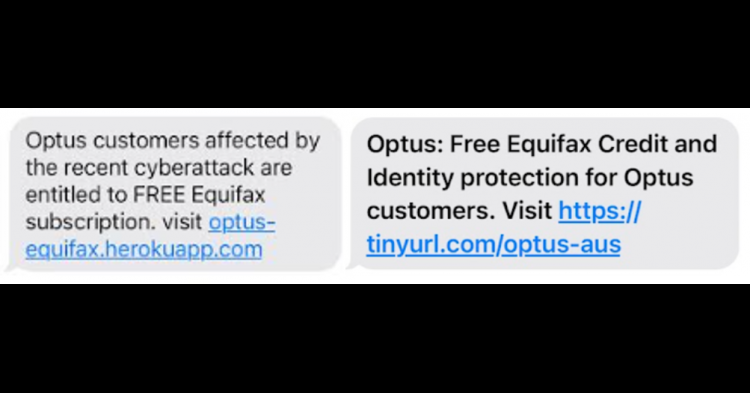

Equifax is aware of an ongoing SMS phishing campaign targeting people impacted by the Optus data breach. DO NOT click on the link, respond to the sender or enter your personal information. Equifax will never ask you to validate your identity by providing your credit card details.

Business credit demand has increased year-on-year in the September quarter, returning to growth following a dip in Q2.

Equifax data shows strong demand for unsecured credit, while buy now pay later growth eases and mortgage demand continues to fall

If you are a residential builder or developer and fail to make adequate legal provisions to protect your customers, your iCIRT rating may be affected.

Market conditions tighten the reins on financial management, requiring a sophisticated 360-customer view, according to the National Credit Managers Survey 2022 from Equifax

The 2022 Mortgage Broker Industry Pulse check provides a snapshot of evolving work practices and technology adoption in Australia's mortgage broking industry.

Educating and supporting borrowers on how to navigate the changing economic environment places extra pressures on time-poor mortgage brokers. We asked Peter White, Managing Director of the FBAA, to share his thoughts on how brokers can keep up with the increased need to work proactively with clients, and the role of technology in freeing up brokers' time.

The Buy Now Pay Later (BNPL) providers has exploded over the last two years, and this highly competitive small share of unsecured lending continues to attract new players drawn by strong consumer demand for flexible payment options. We asked Alberto Fernandez, Head of Insights at Latitude Financial Services, to share his thoughts about the risks and rewards of operating in this space.