Why subscribe?

With a choice of Equifax subscriptions, you can get alerts when changes are made to your credit report and when your personal information is found on the dark web.

Protect yourself today and reduce your risk of becoming a victim of identity crime.

If you have been impacted by a data breach and have received an Equifax Protect promo code, redeem here.

There are three Credit Reporting Bodies in Australia and you are able to obtain a copy of your free credit report held by them.

If you are unable to order your free credit report online via our website, you can also request it by other means. Click here for details.

* Eligibility criteria applies. You’re eligible if you’ve been declined credit in the last 90 days or had an item corrected on your Equifax credit report or once every three months.

Sole trader

Sole trader

If you are a sole trader with an outstanding tax debt, please run a Swiftcheck report to see the details.

Authorised access seeker

Authorised access seeker

If you are an Authorised Access Seeker such as a credit repairer, financial counsellor, broker or third party accessing an Equifax Credit Report on someone's behalf, you can only request Equifax Credit Reports through our My Credit File website here.

It’s easy to get started

1. Sign up online

1. Sign up online

2. Upload your documents

2. Upload your documents

3. Get verified

3. Get verified

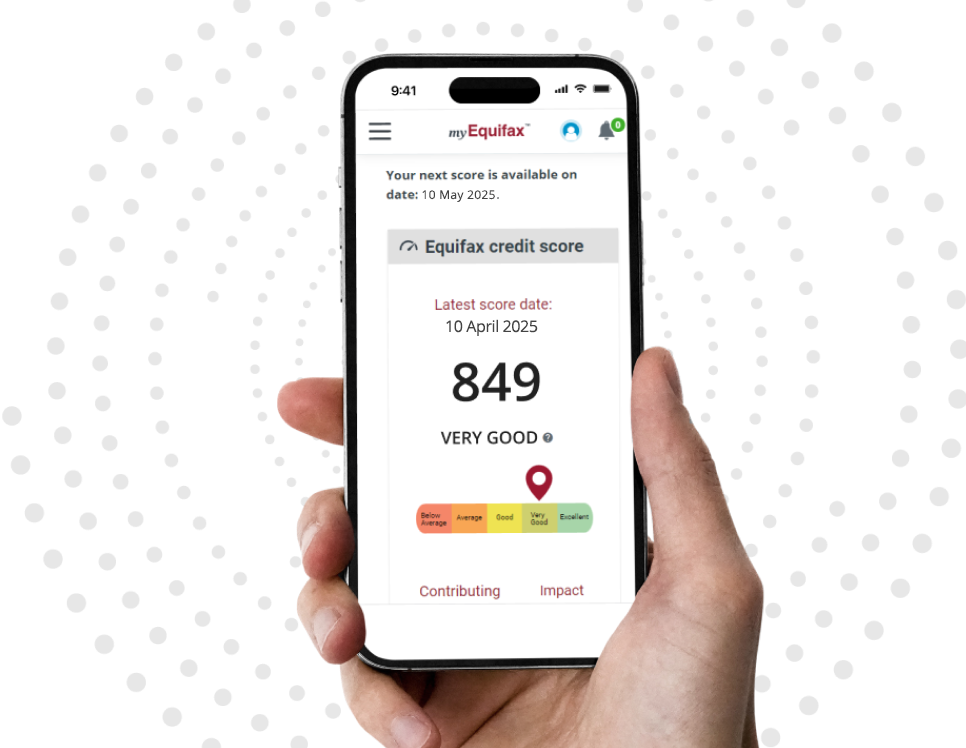

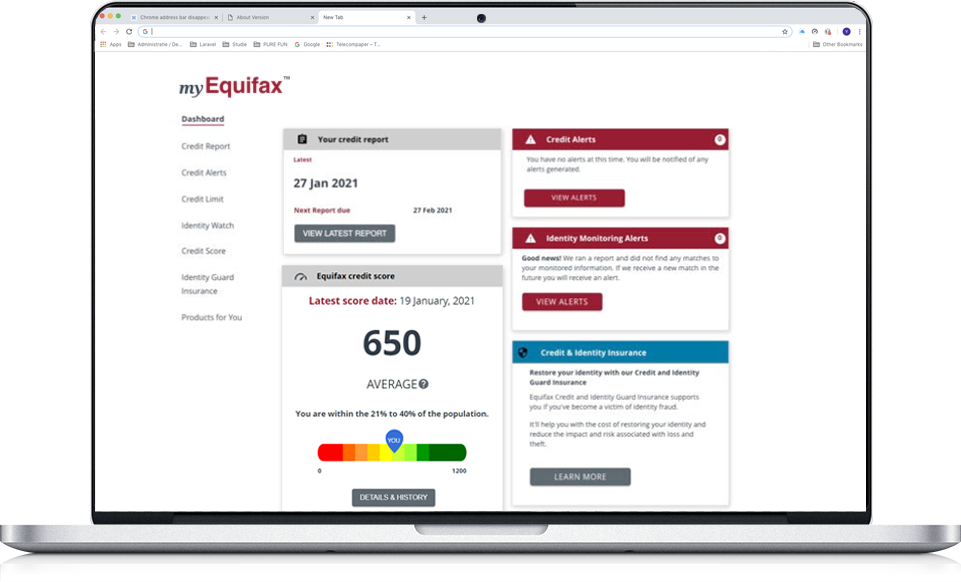

4. Access your dashboard

4. Access your dashboard

Equifax Help Centre

Access helpful services and useful information to help you take control of your credit profile, and better protect yourself from identity theft and fraud.

Understand your Equifax Credit Report

It can be quite complex but here’s a host of helpful hints in learning how to read your Equifax Credit Report

Read More

Correct your Equifax Credit Report

If you’ve found a mistake on our Equifax Credit Report, learn about what steps you can take to fix it

Read More

Learn about

Credit Scores

Why are credit scores important and how do banks and financial institutions use them?

Read More

Denied Credit

If you’ve been denied credit for a home loan, personal loan or credit card, here are some useful tips on what to do next

Read More